#YouTubeMusic #Google #MusicStreaming #Singles #Remix

YouTube overhauled its music streaming app in early 2018, and it's taken off since then.

The Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) subsidiary grew its music streaming app from fewer than 8 million active users at the end of 2017, to more than 77 million active users by the end of 2019, according to data from App Annie.

Much of that growth stems from launches in developing markets like India and Brazil, which capitalizes on the popularity of its free video streaming platform on mobile.

Spotify (NYSE:SPOT) has contended that YouTube is the biggest free music streaming service in the world since it filed to go public. And since it made its direct listing, YouTube Music has proven a formidable competitor. Spotify still boasts a lot more users than YouTube -- 248 million total including 113 million premium subscribers -- but the success of YouTube cannot be discounted.

Lots of free listeners

YouTube is well-positioned to offer users a free listening experience, thanks to its existing deals with record labels for its video streaming app. The free listening tier has enabled it to attract millions of listeners in quick order.

In India, for example, YouTube Music saw 3 million downloads within its first week of launch and has about 10 million active users as of the end of 2019. Just 800,000 of those users pay to listen ad-free. Still, that 800,000 paid subscriber count makes YouTube Music the most popular paid streaming option in the country.

The free tier has been a key pipeline for Spotify, differentiating it from competitors like Apple (NASDAQ:AAPL) Music, which only has a paid tier. Other competitors offer a free tier but severely limit listening options. The free tier is particularly important in attracting consumers in emerging markets where discretionary budgets are thin.

That's particularly noticeable in the discrepancy between Spotify's total listeners and its paid listeners in Latin America and the rest of the world. Those regions account for 38% of its total users, but just 30% of subscribers. What's more, that gap is widening. It was just 4 percentage points a year ago.

YouTube Music has other massive competitive advantages

YouTube's ability to offer a free tier makes it easy for consumers to try out the service, but YouTube has several advantages that can improve everything from gross additions to user retention.

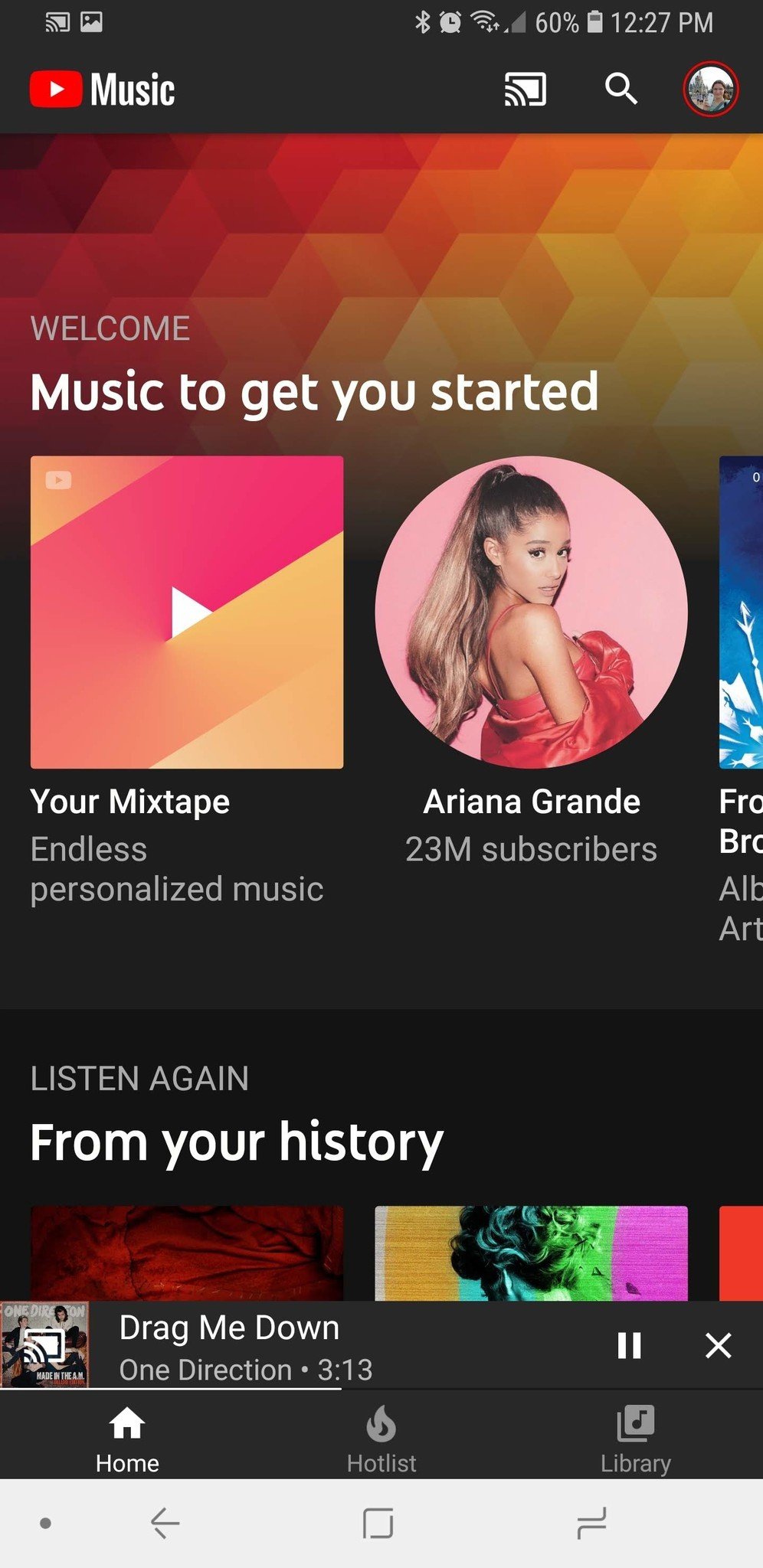

First and foremost, YouTube's brand is extremely well-known all over the world. It has over 2 billion monthly active users, most of whom use it on mobile. App Annie says YouTube Music's growth largely stems from cross-promotion in YouTube and Google's other apps.

Last fall, Google made the ultimate move in cross-promotion for YouTube Music, making it the default music app in new Android phones. Owning the default music player on mobile is extremely powerful. Apple's management says Apple Music is more popular than Spotify on iOS devices, and that's largely thanks to making it the default music app. On the other hand, Apple Music has struggled to attract an audience outside of iOS.

Additionally, YouTube Music offers access to music videos for songs that have them. This is a distinct advantage provided by YouTube's main video platform. Offering access to music videos can help with both attracting new subscribers and retaining existing ones.

Finally, YouTube is taking advantage of its user data and its parent companies' artificial intelligence to create algorithmically generated playlists. It launched its first set of playlists in December. Spotify pointed to its playlists, including personalized playlists, as a competitive advantage in its S-1 filing in 2018. They account for about 17% of listening hours on the platform.

Spotify notably uses Google's cloud computing platform in order to crunch the data and generate personalized playlists for its 248 million users. YouTube is able to use that same technology to feed its own algorithms.

It's worth pointing out that Google is only just starting to invest resources in YouTube Music, and two of these big moves -- making it the default app and introducing personalized playlists -- are only a few months old. Both could result in much more user growth in 2020 and beyond, particularly in emerging markets where there are still lots of consumers to win over.

Comments

Post a Comment